Flandreau

1. During a bear market, big funds slowly buy cheap assets; when the bull market arrives, retail investors chase high and enter the market.

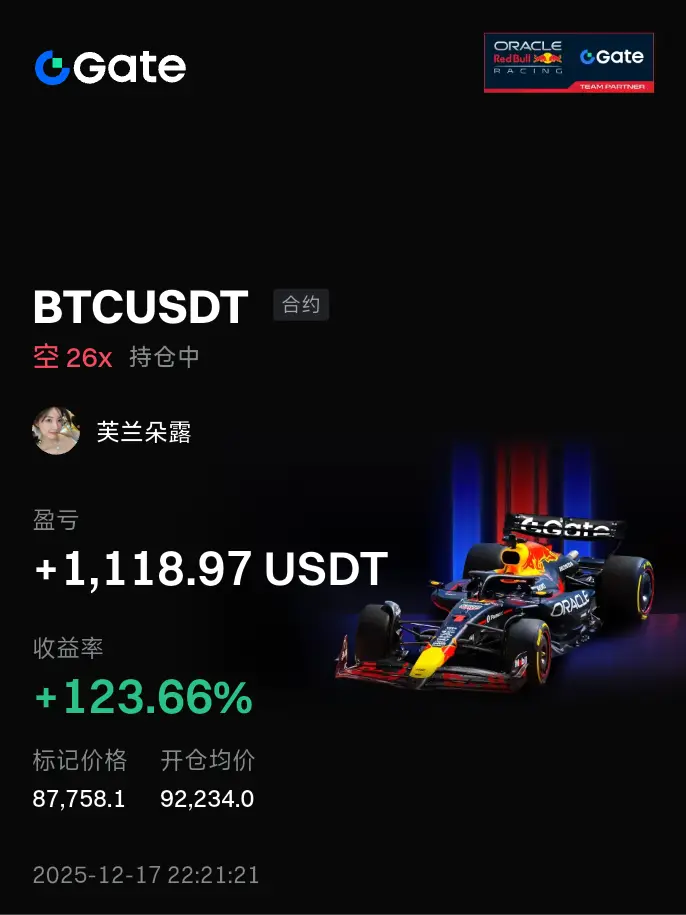

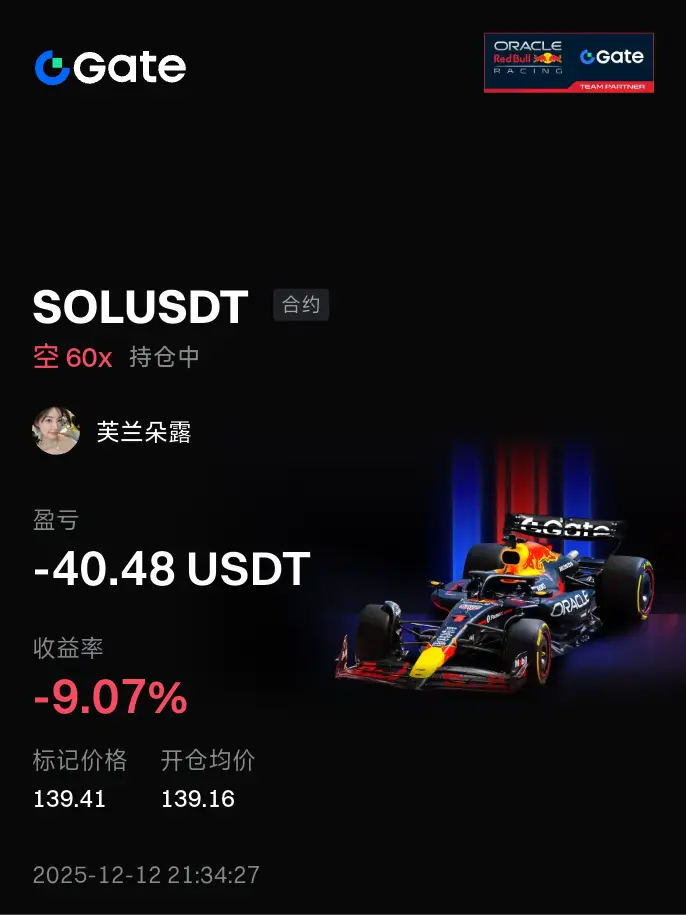

2. Retail investors can't afford to lose, but big players are not afraid of losing.

3. Retail investors know pain, but don't know fear. They'd rather lose money than admit the market is dangerous and be cautious.

4. Good news doesn't necessarily lead to a rise, but bad news often causes a decline.

5. Bull markets (rising) generally last much longer than bear markets (falling).

6. Retail investors become timid after making money, but tend to get emotional a

View Original2. Retail investors can't afford to lose, but big players are not afraid of losing.

3. Retail investors know pain, but don't know fear. They'd rather lose money than admit the market is dangerous and be cautious.

4. Good news doesn't necessarily lead to a rise, but bad news often causes a decline.

5. Bull markets (rising) generally last much longer than bear markets (falling).

6. Retail investors become timid after making money, but tend to get emotional a