Post content & earn content mining yield

placeholder

0xVexel

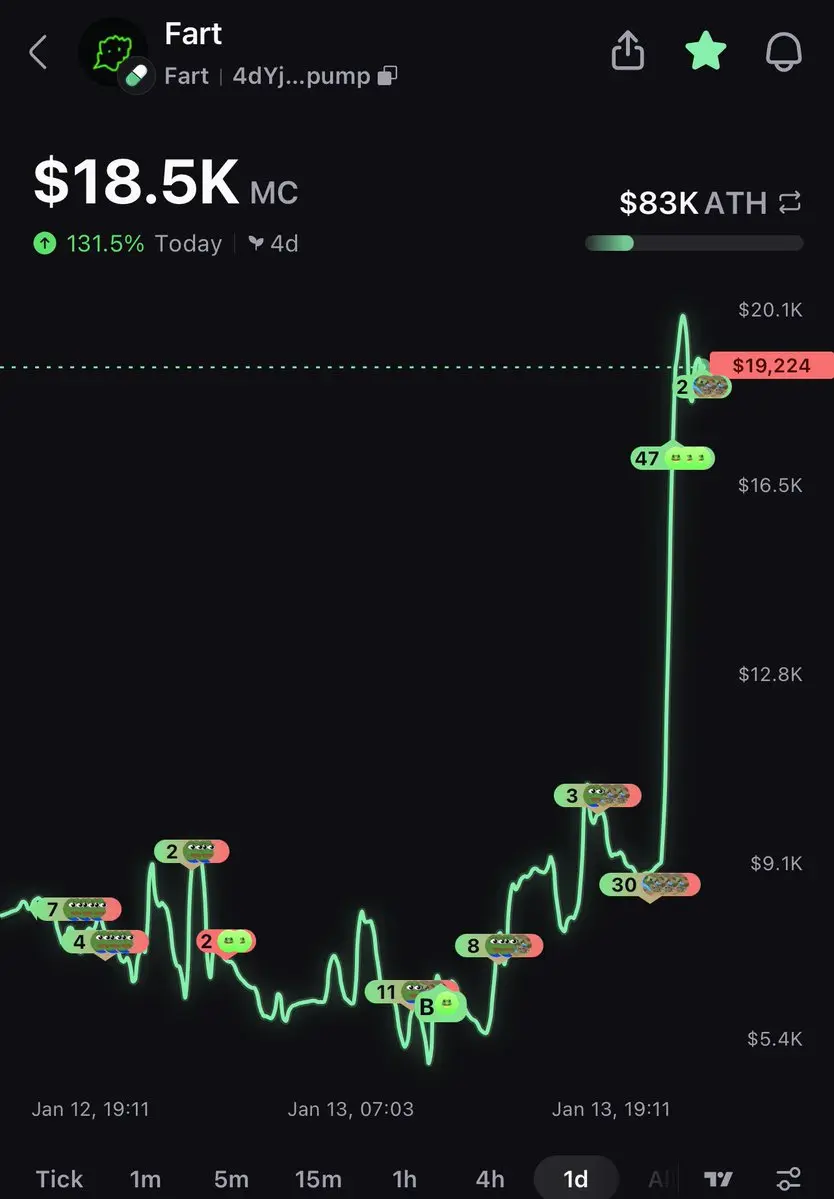

Everyone is praising and admiring the small p players who fill the bottom, drain most of the pool, and are on-chain kings.

View Original

- Reward

- like

- Comment

- Repost

- Share

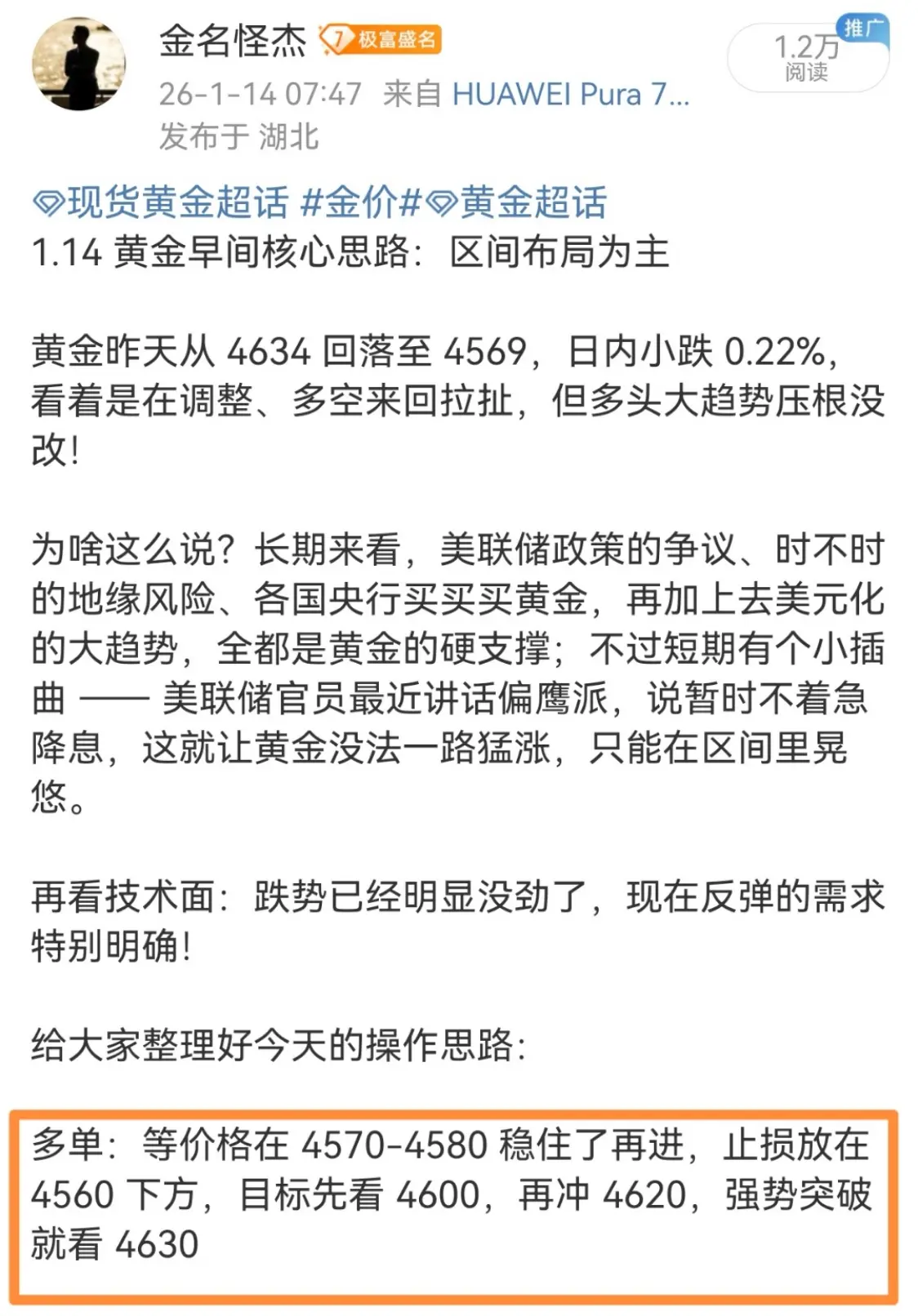

Under verification, in the morning strategy practice!

View Original

- Reward

- 1

- 1

- Repost

- Share

NingxiFour :

:

New Year Wealth Explosion 🤑#XMRHitsNewHigh

Why Privacy Is Emerging as a Scarce Asset in the Next Crypto Cycle

Monero’s push into new price territory is not a short-term momentum event. It reflects a structural repricing of privacy in an era where financial surveillance is expanding faster than financial freedom. As monitoring becomes embedded across payment rails, exchanges, and blockchain analytics, privacy is shifting from an ideological choice to a functional necessity.

XMR’s relative strength is a direct response to this reality. It solves a problem that most digital assets either ignore or deliberately compromise.

Why Privacy Is Emerging as a Scarce Asset in the Next Crypto Cycle

Monero’s push into new price territory is not a short-term momentum event. It reflects a structural repricing of privacy in an era where financial surveillance is expanding faster than financial freedom. As monitoring becomes embedded across payment rails, exchanges, and blockchain analytics, privacy is shifting from an ideological choice to a functional necessity.

XMR’s relative strength is a direct response to this reality. It solves a problem that most digital assets either ignore or deliberately compromise.

- Reward

- 5

- 7

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

败了吗?

败了吗?

Created By@CurlyHairIsFine.

Listing Progress

0.00%

MC:

$3.71K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

I won’t tell you when I win, but there will be signs

- Reward

- like

- Comment

- Repost

- Share

#中文Meme币热潮 🔥 Satoshi Coin: The True Heir of Bitcoin Spirit?

Crypto friends, do you still remember Bitcoin's original vision? Decentralization, financial freedom, peer-to-peer transactions... Now, a project named after Bitcoin creator "Satoshi Nakamoto" is emerging, aiming to reclaim the original intention of the crypto world!

💥 Why is Satoshi Coin worth paying attention to? The Gate Chinese section has officially launched, and the Satoshi token is taking the lead.

📈 The ecosystem is exploding:

· An NFT marketplace is about to launch, and holding 300,000 Satoshi tokens will get you a

View OriginalCrypto friends, do you still remember Bitcoin's original vision? Decentralization, financial freedom, peer-to-peer transactions... Now, a project named after Bitcoin creator "Satoshi Nakamoto" is emerging, aiming to reclaim the original intention of the crypto world!

💥 Why is Satoshi Coin worth paying attention to? The Gate Chinese section has officially launched, and the Satoshi token is taking the lead.

📈 The ecosystem is exploding:

· An NFT marketplace is about to launch, and holding 300,000 Satoshi tokens will get you a

- Reward

- 1

- Comment

- Repost

- Share

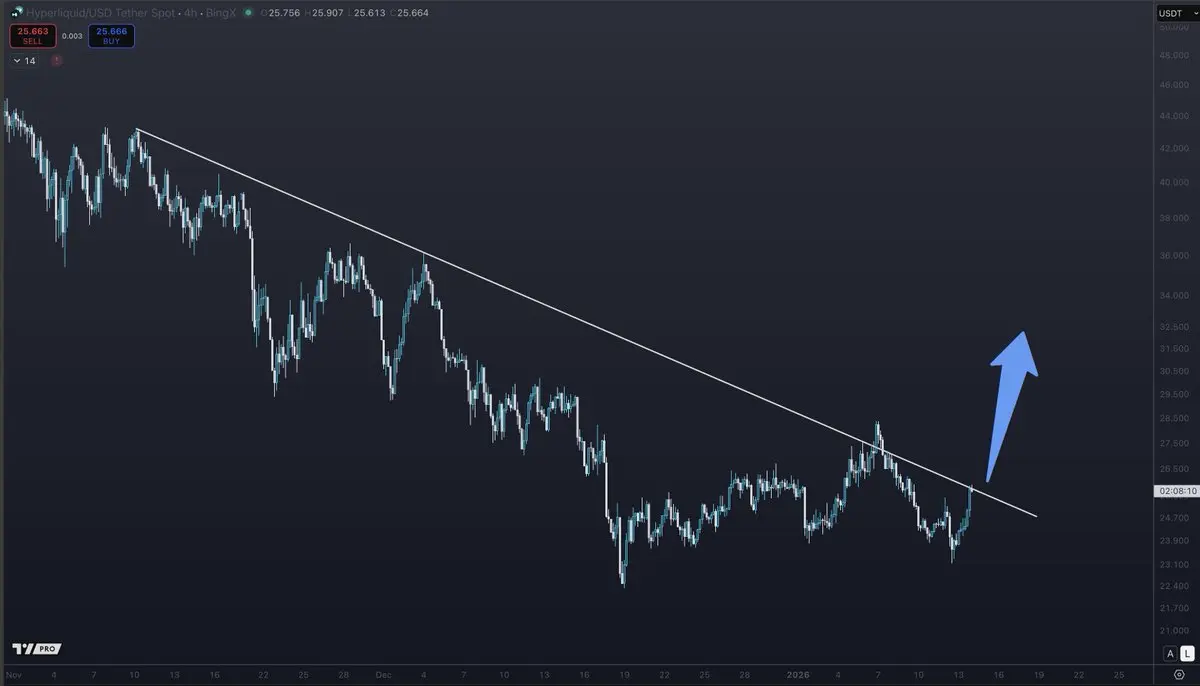

New floor might be in

Will trim in small amounts so it doesn’t impact price once it starts moving up so everyone gets a fair share

Will trim in small amounts so it doesn’t impact price once it starts moving up so everyone gets a fair share

- Reward

- like

- Comment

- Repost

- Share

#ChineseMemecoinBoom

Culture Is Driving Capital in Crypto’s Newest Speculative Wave

The crypto market in early 2026 is witnessing a powerful narrative shift: Chinese-themed memecoins are emerging as a major speculative force, especially across high-throughput ecosystems like BNB Chain. This is not a random meme cycle it is a culture-driven liquidity event with visible on-chain impact.

Unlike previous meme waves that relied purely on Western social media hype, this surge is rooted in language, local internet culture, symbolism, and collective identity, transforming memes into fast-moving fina

Culture Is Driving Capital in Crypto’s Newest Speculative Wave

The crypto market in early 2026 is witnessing a powerful narrative shift: Chinese-themed memecoins are emerging as a major speculative force, especially across high-throughput ecosystems like BNB Chain. This is not a random meme cycle it is a culture-driven liquidity event with visible on-chain impact.

Unlike previous meme waves that relied purely on Western social media hype, this surge is rooted in language, local internet culture, symbolism, and collective identity, transforming memes into fast-moving fina

- Reward

- 5

- 8

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

This image says it all 🌿

It starts with you. Make a difference.

Read the article 👉

Earn GREEN when you act with ECOX Network:

#ECOX #GREEN #ECO_TO_EARN

It starts with you. Make a difference.

Read the article 👉

Earn GREEN when you act with ECOX Network:

#ECOX #GREEN #ECO_TO_EARN

View Original

- Reward

- like

- Comment

- Repost

- Share

January 14

1. Bitcoin Market: Bitcoin has finally chosen a direction. During the night trading session, Bitcoin continued to rise, and this morning, with high volume, it broke through two important resistance levels at 92,500 and 95,000. Currently, it closed around 95,400. Guess what? The next target should be around 100,000. Over the past two weeks, the little whale has been bullish, and the family members paying attention should be eating meat. Ethereum's trend is stronger than Bitcoin; this morning, it briefly surged to 3,380, then oscillated, currently around 3,330.

2. Altcoin Market: Gate

View Original1. Bitcoin Market: Bitcoin has finally chosen a direction. During the night trading session, Bitcoin continued to rise, and this morning, with high volume, it broke through two important resistance levels at 92,500 and 95,000. Currently, it closed around 95,400. Guess what? The next target should be around 100,000. Over the past two weeks, the little whale has been bullish, and the family members paying attention should be eating meat. Ethereum's trend is stronger than Bitcoin; this morning, it briefly surged to 3,380, then oscillated, currently around 3,330.

2. Altcoin Market: Gate

- Reward

- 5

- 6

- Repost

- Share

ShizukaKazu :

:

Good morning, prosperity💰View More

#DoubleRewardsWithGUSD

Unlocking Stablecoin Potential: How the GUSD Dual Reward Program is Redefining Yields by 2026

As the crypto market evolves, the narrative around stablecoins is shifting from mere capital preservation to active yield generation. GUSD (Gemini US Dollar), a fully regulated USD-backed stablecoin, stands out in this transition with its dual reward program, offering investors a unique opportunity to maximize returns without sacrificing stability.

Why GUSD Stands Out in Today’s Market

Enhanced Yields Through Dual Rewards

Traditional stablecoin projects offer basic returns, but

View OriginalUnlocking Stablecoin Potential: How the GUSD Dual Reward Program is Redefining Yields by 2026

As the crypto market evolves, the narrative around stablecoins is shifting from mere capital preservation to active yield generation. GUSD (Gemini US Dollar), a fully regulated USD-backed stablecoin, stands out in this transition with its dual reward program, offering investors a unique opportunity to maximize returns without sacrificing stability.

Why GUSD Stands Out in Today’s Market

Enhanced Yields Through Dual Rewards

Traditional stablecoin projects offer basic returns, but

- Reward

- like

- Comment

- Repost

- Share

Notification📢📢📢

The morning live broadcast has been delayed to 9:30!

View OriginalThe morning live broadcast has been delayed to 9:30!

- Reward

- 2

- 1

- Repost

- Share

GateUser-d3d18387 :

:

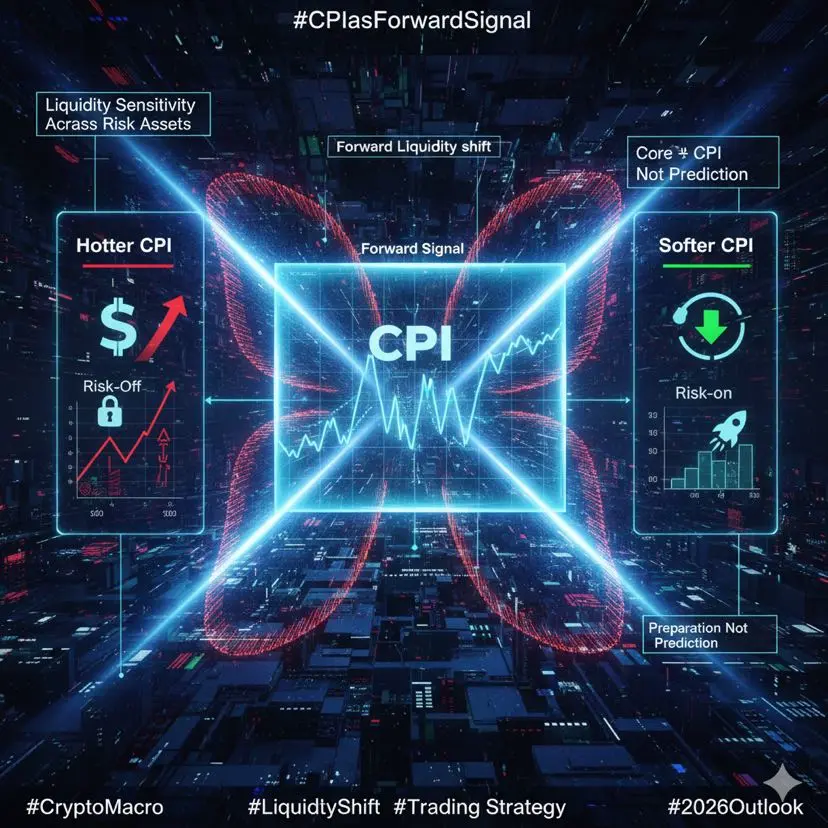

New Year, charge ahead! Let the coins take off to the moon. Keep going, keep going!#CPIDataAhead CPI as a Forward Signal: Preparing for the Next Liquidity Shift

As the next CPI release approaches, markets are entering a phase where data outweighs narrative. In 2026, inflation prints remain one of the strongest drivers of short-term positioning, shaping expectations around monetary flexibility, liquidity conditions, and cross-asset capital flow.

This CPI report is not just a backward-looking measure — it is a forward signal for how much room central banks may have in the months ahead.

Why This CPI Print Is a Future Catalyst

1. Expectations Are Fragile

Markets are finely price

As the next CPI release approaches, markets are entering a phase where data outweighs narrative. In 2026, inflation prints remain one of the strongest drivers of short-term positioning, shaping expectations around monetary flexibility, liquidity conditions, and cross-asset capital flow.

This CPI report is not just a backward-looking measure — it is a forward signal for how much room central banks may have in the months ahead.

Why This CPI Print Is a Future Catalyst

1. Expectations Are Fragile

Markets are finely price

BTC4,55%

- Reward

- 1

- Comment

- Repost

- Share

散户牛币

散户牛币

Created By@CurlyHairIsFine.

Listing Progress

0.00%

MC:

$0.1

Create My Token

Bitcoin Options Interest Surpasses Futures, Shifts to Risk Management - - #cryptocurrency #bitcoin #altcoins

BTC4,55%

- Reward

- 1

- 1

- Repost

- Share

GateUser-011d3e61 :

:

hahahahahaha$BTC

Bitcoin has retraced toward the $95K resistance zone, a key psychological and technical level where price often decides direction either breakout or rejection. Technicals show this area has served as resistance recently, with selling pressure near $95–$96K and critical support zones lower around the $90–$92K range.

🔹 Bullish scenario:

A clean break and sustained hold above $95K–$96K opens momentum toward $98K–$100K+. Bulls need volume and strength to flip this zone into support.

🔹 Neutral / range:

If BTC holds between $92K–$95K, look for chopping price action sideways movement until

Bitcoin has retraced toward the $95K resistance zone, a key psychological and technical level where price often decides direction either breakout or rejection. Technicals show this area has served as resistance recently, with selling pressure near $95–$96K and critical support zones lower around the $90–$92K range.

🔹 Bullish scenario:

A clean break and sustained hold above $95K–$96K opens momentum toward $98K–$100K+. Bulls need volume and strength to flip this zone into support.

🔹 Neutral / range:

If BTC holds between $92K–$95K, look for chopping price action sideways movement until

BTC4,55%

- Reward

- like

- 1

- Repost

- Share

gongyan :

:

Hold on tight, we're about to take off 🛫- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More30.06K Popularity

30.07K Popularity

28.56K Popularity

19.08K Popularity

109.1K Popularity

Hot Gate Fun

View More- MC:$3.71KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$3.71KHolders:10.00%

- MC:$3.71KHolders:10.00%

- MC:$3.71KHolders:10.00%

News

View MoreMaji Gege gradually takes profit on 2,450 ETH long positions, with the remaining position valued at $29.27 million.

1 m

Data: Hyperliquid platform whale current holdings $6.725 billion, long-short position ratio is 0.94

3 m

Market Report: Top 5 Cryptocurrency Gainers on January 14, 2026, with Dash leading the gains

4 m

DeepNode responds to DN's 80% plunge: Working with market makers to address DN liquidity depth issues

6 m

NOT (Notcoin) increased by 26.02% in the past 24 hours

7 m

Pin