Market Opinion

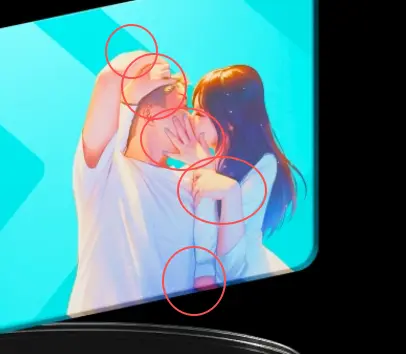

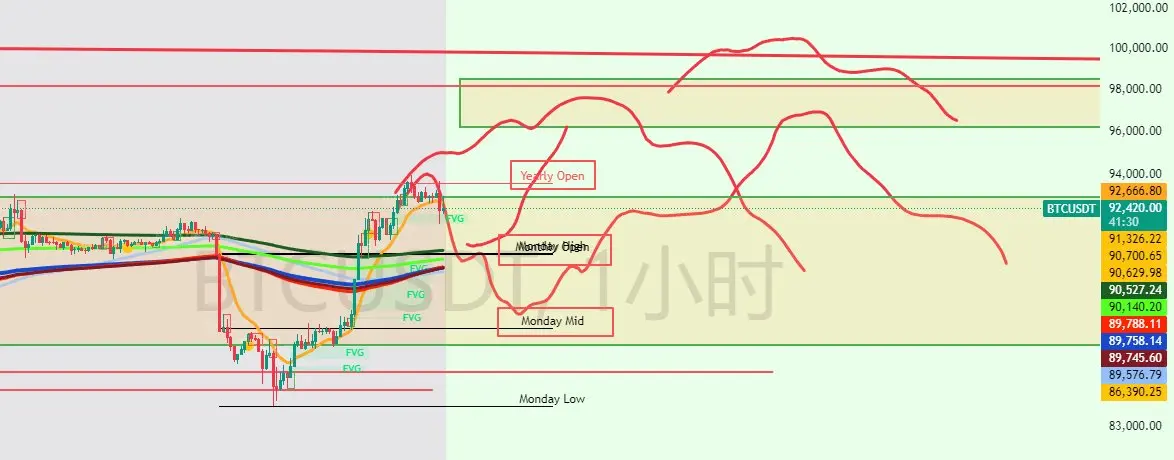

The new lowest point of the pullback may be around 89,000.

I hope everyone received our reminders from yesterday’s and the day before’s analysis that a pullback was expected.

Bitcoin hit a low of 90,800 last night, which is 200 points away from our anticipated level of 90,600. There has been a slight rebound, but the highest point still hasn’t broken through 93,000.

I believe that a 1H breakout above 93,000 would confirm the end of the pullback, meaning it won’t go to a lower level.

If 93,000 is not broken, it’s possible that an even lower low will be reached.

The lower low is e

The new lowest point of the pullback may be around 89,000.

I hope everyone received our reminders from yesterday’s and the day before’s analysis that a pullback was expected.

Bitcoin hit a low of 90,800 last night, which is 200 points away from our anticipated level of 90,600. There has been a slight rebound, but the highest point still hasn’t broken through 93,000.

I believe that a 1H breakout above 93,000 would confirm the end of the pullback, meaning it won’t go to a lower level.

If 93,000 is not broken, it’s possible that an even lower low will be reached.

The lower low is e

BTC-1.34%